child tax credit september 2021

Child tax credit dates 2021 latest August 30 deadline to opt-out of September payments as parents flock to IRS portal. September 28 2021 1027 AM MoneyWatch.

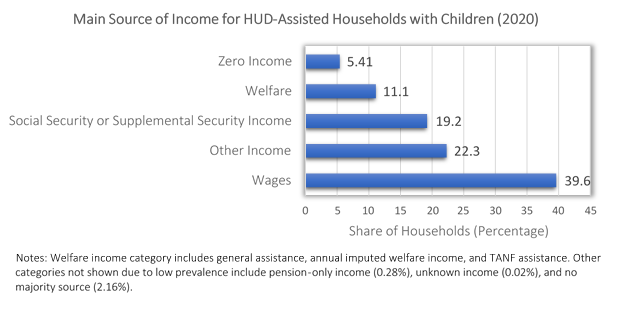

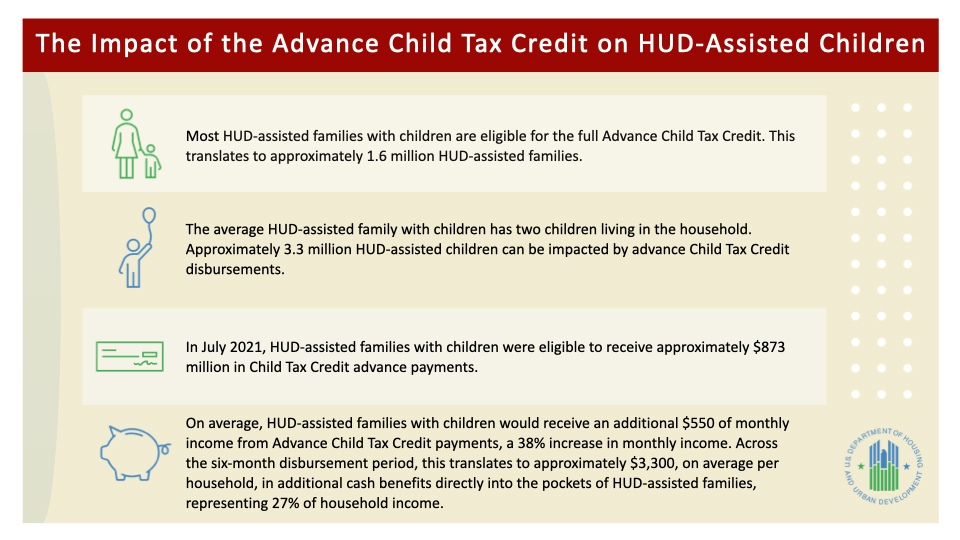

The Advance Child Tax Credit An Opportunity For Hud Assisted Families With Children Hud User

Ad Explore detailed reporting on the Economy in America from USAFacts.

. IR-2021-188 September 15 2021 WASHINGTON The Internal Revenue Service and the Treasury Department announced today that millions of American families are now receiving their advance Child Tax Credit CTC payment for the month of September. 3600 for children ages 5 and under at the end of 2021. Thats up to 7200 for twins This is on top of payments for any other qualified child dependents you claim.

The American Rescue Act of 2021 temporarily increases the Child Tax Credit up to 3600 per child under age six and up to 3000 per child under age 18. For tax year 2021 the Child Tax Credit increased from 2000 per qualifying child to. The IRS released a statement about the September delays.

1400 in March 2021. That drops to 3000 for each child ages six through 17. Parents of about 60 million children will receive direct deposit payments on September 15 while some may receive the checks through the mail anywhere from a few days to a week later.

So each month through December. The American Rescue Plan increased the amount of the Child Tax. Half of the total is being paid as six monthly payments and half as a 2021 tax credit.

3000 for children ages 6. This will allow new parents with a baby born in 2021 to take advantage of the tax credit payments they now. 15 opt out by.

This isnt a problem to do. Child Tax Credit Norm Elrod. Here is some important information to understand about this years Child Tax Credit.

This will allow new parents with a baby born in 2021 to take advantage of the tax credit payments they now qualify for. Missing your September child tax credit payment. 0 Federal 0 State 0 To File offer is available for simple tax returns only with TurboTax.

Here Are The September 2021. IR-2021-188 September 15 2021. The monthly child tax.

Specifically the Child Tax Credit was revised in the following ways for 2021. Ad The new advance Child Tax Credit is based on your previously filed tax return. Chris Walker 37 a journalist in Madison Wisconsin told CBS MoneyWatch he was expecting a 250 Child Tax Credit payment.

The 2021 child tax credit payment dates along with the deadlines to opt out are as follows. Child Tax Credit Dates 2021 Latest August 30 Deadline To Opt Out Of September Payments As Parents Flock To Irs. It will also let parents take advantage of any increased payments they.

That depends on your household income and family size. By August 2 for the August. The 2017 Tax Cuts and Jobs Act TCJA expanded the Child Tax Credit beginning in 2018 increasing the maximum credit from 1000 to 2000 and the refundable portion of.

Visualize trends in state federal minimum wage unemployment household earnings more. The Child Tax Credit provides money to support American families. IRS sends third child tax credit payments around 15 billion to 35 million families VIDEO 906 0906 How a couple living in an RV making 81000year spend.

File a free federal return now to claim your child tax credit. Eligible families can receive a total of up to 3600 for each child under 6 and up to 3000 for each one age 6 to 17. Half of the total is being paid as six monthly payments and half as a 2021 tax credit.

So parents of a child under six receive 300 per month and parents of a child six or. Nearly every family is eligible to receive the 2021 CTC this year including families that havent filed a tax return and families that dont have recent income. Children born in 2021 make you eligible for the 2021 tax credit of 3600 per child.

The credit amount was increased for 2021. The 2021 child tax credit provides parents with up to 3600 per child for kids under 6 and 3000 for all other children under 18 with half of the money being doled out as monthly.

Child Tax Credit Could Spur 1 5 Million Parents To Leave The Workforce Study Says Cbs News

2021 Child Tax Credit What It Is How Much Who Qualifies Ally

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

How To Claim The Child Tax Credit For A Baby Born In 2021 Goodrx

2021 Child Tax Credit Advanced Payment Option Tas

What Families Need To Know About The Ctc In 2022 Clasp

Child Tax Credit 2021 8 Things You Need To Know District Capital

Updated How Employers Can Claim Arpa Cobra Subsidy Tax Credits Sequoia

Child Tax Credit 2021 8 Things You Need To Know District Capital

News Columbia University Center On Poverty And Social Policy

Tax Changes For Individuals In The American Rescue Plan Act The Cpa Journal

Expiration Of Child Tax Credits Hits Home Pbs Newshour

The Advance Child Tax Credit An Opportunity For Hud Assisted Families With Children Hud User

Expanded Child Tax Credit Continues To Keep Millions Of Children From Poverty In September A Columbia University Center On Poverty And Social Policy

Irs Issues Employer Guidance On Covid 19 Paid Leave Tax Credits Cupa Hr

Will Monthly Child Tax Credit Payments Be Renewed Forbes Advisor